In modern business, companies are constantly seeking ways to optimize their operations and focus on core competencies. One strategy gaining significant traction is outsourcing, particularly in the realm of accounting services. Outsourcing not only allows businesses to streamline their processes but also provides access to specialized expertise without the burden of managing an in-house team.

In this comprehensive guide, we’ll delve into the various types of accounting services that are ideal for outsourcing, shedding light on how this strategic move can take your business forward.

Accounting Services: A Brief Overview

Before we dive into the types of accounting services ideal for outsourcing, let’s establish a fundamental understanding of what accounting services entail. Accounting services encompass a wide array of tasks designed to manage a company’s financial transactions, ensuring accuracy, compliance, and strategic decision-making. These services are typically offered by professional accounting firm that specialize in various aspects of financial management.

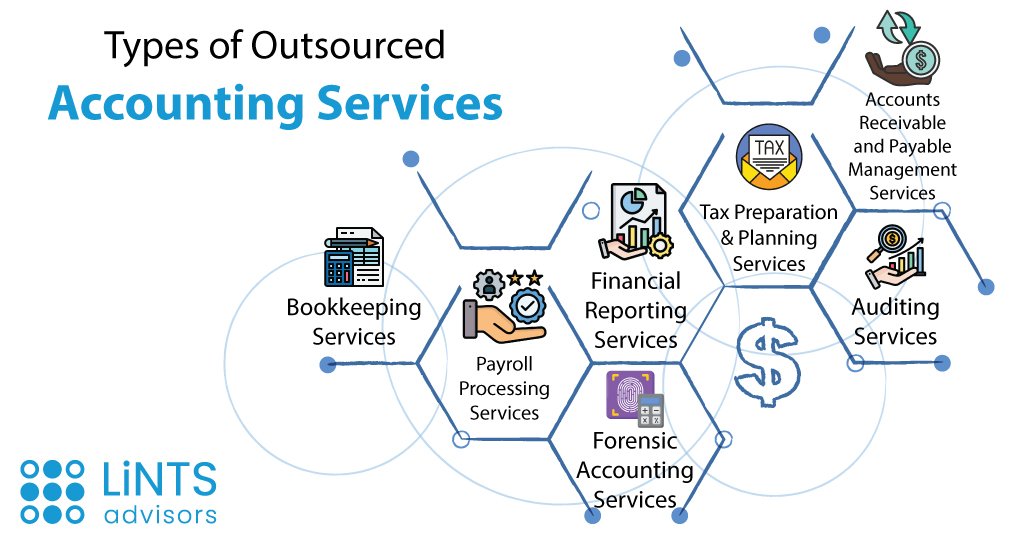

Types of Outsourced Accounting Services

- Bookkeeping Services

Bookkeeping is the foundation of any robust financial management system. Outsourcing accounting bookkeeping services involves delegating the recording and organizing of financial transactions, including invoicing, payroll, and daily financial entries. By outsourcing this fundamental task, businesses can maintain accurate financial records without the need for an in-house team, saving both time and resources.

- Payroll Processing Services

Managing payroll can be a time-consuming and complex task, especially as businesses grow. Outsourcing payroll processing services ensures that employee salaries, taxes, and other deductions are handled accurately and in compliance with relevant regulations. This not only reduces the risk of errors but also allows businesses to focus on strategic initiatives instead of administrative intricacies.

- Financial Reporting Services

Timely and accurate financial reporting is crucial for informed decision-making. Outsourcing financial reporting services involves entrusting experts to generate comprehensive financial statements, performance reports, and analysis. This not only ensures compliance with accounting bookkeeping standards but also provides valuable insights for strategic planning.

- Tax Preparation and Planning Services

Navigating the complexities of tax regulations requires specialized knowledge. Outsourcing tax preparation and planning services to professionals ensures that businesses stay compliant with tax laws while optimizing their tax positions. This strategic move can result in significant cost savings and mitigate the risk of tax-related issues.

- Auditing Services

Audits play a vital role in ensuring transparency and accountability. Outsourcing auditing services involves engaging external auditors to review financial statements and internal controls. This independent perspective enhances the credibility of financial information and provides valuable insights for process improvement.

- Accounts Receivable and Payable Management Services

Efficient management of accounts receivable and payable is essential for maintaining healthy cash flow. Outsourcing these services involves delegating tasks such as invoicing, collections, and vendor payments to external experts. This not only improves cash flow management but also reduces the risk of late payments and associated penalties.

- Forensic Accounting Services

In cases of financial irregularities or fraud, forensic accounting services become crucial. Outsourcing forensic accounting services involves bringing in specialized professionals to investigate, analyze, and prevent financial misconduct. This proactive approach can safeguard the financial integrity of the business.

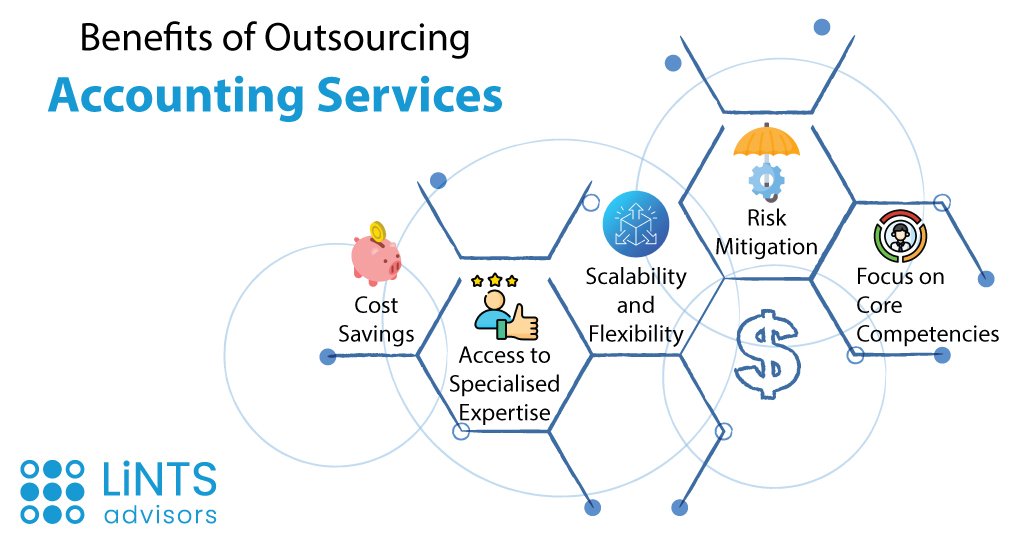

Benefits of Outsourcing Accounting Services

- Cost Savings

Outsourcing accounting services can result in significant cost savings compared to maintaining an in-house accounting team. Businesses can eliminate expenses related to salaries, benefits, training, and infrastructure, allowing them to allocate resources more efficiently.

- Access to Specialized Expertise

At Lints Advisors, Accounting firm that provides outsourcing services typically have a team of specialized professionals with diverse skills. This ensures that businesses have access to a broad spectrum of expertise, from tax specialists to forensic accountants, without the need to hire multiple in-house professionals.

- Focus on Core Competencies

By outsourcing routine and time-consuming accounting bookkeeping tasks, businesses can redirect their focus on core competencies. This strategic reallocation of resources can enhance overall productivity and contribute to the achievement of strategic goals.

- Scalability and Flexibility

Outsourcing provides businesses with the flexibility to scale their accounting services based on their needs. Whether it’s handling increased transaction volumes during peak seasons or streamlining services during slower periods, outsourcing adapts to the changing demands of the business.

- Risk Mitigation

Compliance with ever-changing accounting bookkeeping and tax regulations is a constant challenge. Outsourcing accounting services to professionals mitigates the risk of non-compliance and ensures that businesses stay abreast of the latest regulatory changes, reducing the likelihood of penalties and legal issues.

Conclusion

In conclusion, outsourcing various accounting services offers a myriad of benefits for businesses seeking to optimize their financial management processes. From basic bookkeeping to complex forensic accounting, the outsourcing landscape provides a solution for every need. By capitalizing on these services, businesses can achieve cost savings, access specialized expertise, and enhance overall efficiency, ultimately positioning themselves for sustained success in today’s competitive business environment.

Contact Lints Advisors if you’re looking for an accounting firm as well. They are a vibrant, leading accounting company that provides bookkeeping, accounting & finance, and tax organizations with offshore staffing services.

Financial Sector Trends: What the 2025-26 Budget Reveals

The Union Budget 2025-26, unveiled by Finance Minister Nirmala Sitharaman, has set the stage for transformative changes in India's financial sector. The upcoming budget concentrates on developing economic expansion while making credit options more accessible [...]

Empowering Women: Financial Planning for 2025

In today's dynamic financial world, empowering women through tailored financial planning is more crucial than ever. Women often face unique financial challenges, including longer life expectancies, career breaks for caregiving, and persistent wage gaps. Addressing [...]

Why Is Form 1040 Important for Accounting Firms?

When it comes to the world of taxes, Form 1040 holds a central position. It is often referred to as the "U.S. Individual Income Tax Return" and serves as the primary document taxpayers use to [...]